How I reached $100,000 Net Worth Before I Graduated (With a Little Help and Hard Work!)

When I was 20, I started my first engineering internship. Initially, I was excited to apply what I had learned in college, but soon I realized the reality of a 9-to-5 job and how it would limit my freedom for the next 40 years. This realization led me to discover FIRE (Financial Independence, Retire Early), sparking a journey towards financial freedom. In this post, I’ll share how I achieved a $100,000 net worth before graduating, the help I received, the actions and sacrifices I made, and actionable tips for your own financial journey.

My Journey Towards Financial Independence

Introduction

Hi, I’m Calin. I graduated from my bachelors in Mechanical Engineering in 2020, and have been working towards financial freedom since 2018! On this blog, I share my my journey towards achieving financial freedom. Today, I’m going to talk about how I reached my first $100,000 net worth before finishing my undergraduate degree!

First, I need to acknowledge the help I received…

Listen… I know this is going to sound bad to some people, but I received significant help from my parents in achieving my first $100,000 net worth. Don’t click off just yet though, because my hard work was a large component as well! Their support was crucial and accounted for at least 50% of my success.

So how did they help me?

They covered my $40,000 university tuition and allowed me to live at home rent-free during my studies. This gave me a substantial financial head start and reduced my expenses considerably. Without my parents, I wouldn’t be where I am today, and for that I am extremely grateful. Now lets move on to the actions and sacrifices I took along my first 2 years of my financial freedom journey which helped me reach $100,000 Net Worth.

Hard work and Sacrifices

The other 50% of my journey was hard work and sacrifice. Here’s how I made it happen:

- Academic Excellence: I worked tirelessly to maintain an almost 4.0 GPA, which earned me scholarships totaling $40,000. Since my parents paid for my tuition, this money went directly to my savings. I treated school like a job, studying diligently to excel in my classes. This hard work paid off, not just financially but also by positioning me well for future opportunities

- High-Paying Internship: After my third year, I secured a 16-month internship with a generous salary of $75,000/year, thanks to my high GPA. Living with my parents allowed me to save about 90% of my income, totaling approximately $52,000/year after taxes.

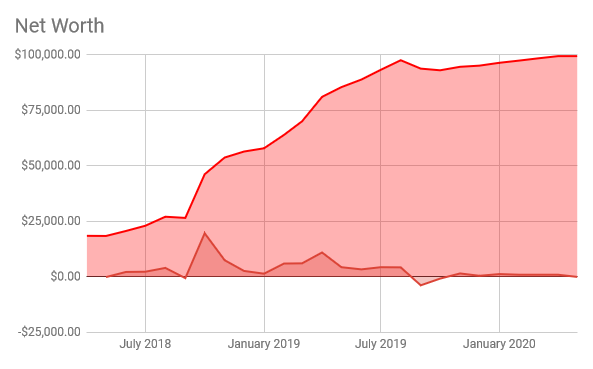

- Investing Wisely: Investing was another key step. I learned how to invest from blogs like Mr. Money Mustache, which essentially recommend that you invest in a total US market etf or an S&P 500 ETF. I maximized contributions to my TFSA and RRSP accounts (similar to Roth IRA and traditional IRA in the US) and invested in ETFs like VFV. The market crash in March 2020 was challenging because it hurt to see my investments drop by ~30%, but I trusted what I had been learning about investing and it turned into an opportunity to buy more at lower prices. By May 2020, just before graduation, my net worth hit $100,000.

- Educating myself on budgeting, investing, FIRE and business: I used to take the train to and from work, which was 2 hours total of commute time. Instead of scrolling social media apps, I used my time wisely and read finance books and blogs. Over my 16 month internship, this amounted to over 500 HOURS of reading. I think this was crucial for me to gain the confidence to begin taking action in my life.

Lessons Learned

- Hard Work Pays Off: Dedication in school and work leads to financial rewards. Without hard work, I wouldn’t have received $40,000 in scholarships or secured a high-paying internship.

- Income vs. Expenses: Financial independence is about maximizing income and minimizing expenses. The quicker you can save and invest the difference, the sooner you can retire early.

- Market Patience: Investing aggressively during downturns is beneficial as markets historically recover. The pandemic market crash taught me to buy low and trust in long-term recovery.

- Start Early: The earlier you start saving and investing, the more you benefit from compounding. My early efforts are paying off significantly now.

Actionable Tips for Your Financial Journey

- Track Your Spending: Understand where your money goes. Start by tracking all expenses and create a budget to cut unnecessary costs. Aim to reduce your monthly spending by at least $100 after you read this post. (I’ve included a free budget template if you sign up for my newsletter here)

- Learn About Investing: Educate yourself about investing. Begin with ETFs and understand indices like the S&P 500. I invest in Vanguard’s VFV ETF, which tracks the S&P 500. I think keeping it simple with ETFs is one of the best decisions you can make. The less friction there is between you and investing the better. Understand that retiring early is just a % game between income and expenses. Once you have reached the point where your expenses are equal to 4% of your investments, you can retire. What is also crazy is that you can achieve this in a reasonable amount of time. If you save 65% of your income, regardless of what that income is in absolute terms, you can retire in 10.5 years (assuming net 5% returns every year, which is quite conservative!). For more information on FIRE, read The Simple Path to Wealth: Your road map to financial independence and a rich, free life.

- Use Tax-Advantaged Accounts: Explore registered or tax-advantaged accounts in your country. In Canada, we have the TFSA (Tax Free Savings Account; Contributions are post-tax, and gains are tax-free) and RRSP (Registered Retirement Savings Plan; Contributions are deducted from your income, tax is deferred until you withdraw in the future). I believe the US equivalent for these accounts are the Roth IRA and traditional IRA respectively. These accounts are crucial for long-term wealth building.

- Commit to Financial Education: Dedicate at least 30 minutes daily to learning about financial independence, investing, budgeting or business. Your efforts will compound over time, leading to greater knowledge and financial success.

- Take Action: After you get a good base of financial knowledge, begin to take action on budgeting, saving and investing. Learning without action will not help you. Everything is a skill and you will need to build these financial skills up. It’s okay to make mistakes, you will learn from them and get better.

Conclusion

I hope you found this post valuable. Achieving financial freedom is a journey that combines support, hard work, and smart investing. For more tips and insights, join my newsletter for a free budget Excel template and updates on my financial freedom journey. Together, we can achieve our financial goals and enjoy the freedom we desire.

Youtube video: