Build The Life You Want, Then Save For It

Saving, investing and striving for financial independence does not mean you need to live like a hermit and deprive yourself. Stop depriving yourself of the things you love and start maximizing the things that you value, while still maintaining a level of saving. It’s too risky to go through life sacrificing the present for a future that is not guaranteed, and even if you do reach retirement faster by depriving yourself, you may not know what do with your life when you get there. and that’s why, today, I want to share a powerful idea from the FIRE community that may change the way you think about your financial independence journey. It’s called “Build the life you want, then save for it”. (Original Reddit Post)

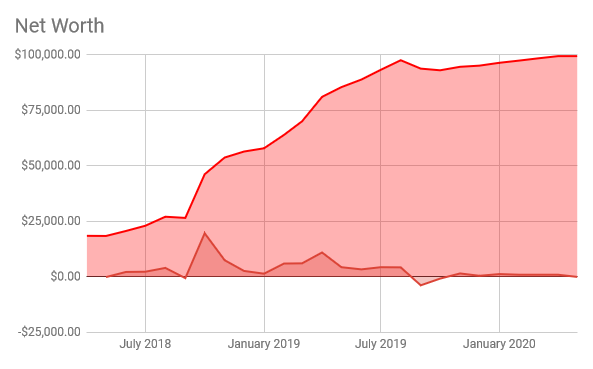

I’m Calin and I’ve been working towards financial independence since I was 20 years old. Last week, I made a post describing how I save 66% of my income, and brought up the question of “Am I depriving myself?” I came to the conclusion that I do not think I am depriving myself because I am maximizing the things that I love, and still living a fulfilling life. While that is true, the more I thought about it, I think that I am actually depriving myself in terms of other big goals that I have in my life, which I’m not really allowing myself to experience because of needing to have a full time job. One of my biggest dreams is to travel around the world and experience all the different types of nature and culture. I’ve been telling myself that I will do this when I retire, but why not start now.

How It Works

Let’s dive into the concept of “Build the life you want, then save for it”. Fundamentally, the idea boils down to envisioning and beginning to live your ideal life now instead of when you retire. Even doing things in a scaled back way would be beneficial because you are realizing your dreams now instead of waiting. When you think about it, it’s actually quite risky to not do this, because what if you actually don’t like what you are dreaming of? We’re humans, we are sometimes wrong when we think we will like something! With this shift in perspective, you should be happier because you are doing the things you are dreaming of and experimenting with what you actually plan to do in retirement.

The original reddit post on this topic encourages you to ask yourself some tough questions: What do you truly value? What brings you joy and fulfillment? Are you pursuing a career you love or just one that pays the bills? Do you want to rent or own a home? These questions can be uncomfortable, but they are crucial for building a life that brings you happiness.

Let’s take a moment to think about this. Imagine waking up every day excited about your life. What are you doing? Who are you with? Where are you?

How I Am Building My Life

For me, it’s about having the freedom to spend time with loved ones, explore new hobbies, and travel the world. It’s about having the flexibility to work on projects I’m passionate about, not just ones that pay the bills. For me, I don’t particularly find my career very fulfilling, so that is probably the one area in my life that I can try to change to bring more happiness. Once you have a clear vision of the life you want, you start planning your finances around that vision. You identify the costs associated with your ideal life and work towards achieving that, rather than an arbitrary savings goal.

For example, my dream involves traveling the world, so I can research the cost of living in different countries, find ways to earn money remotely, and create a savings plan that supports this lifestyle. It’s not just about cutting expenses; it’s about aligning your spending with your values.

In my early years of saving, I focused on saving as much as possible, keeping my eyes on that $1 million dollar goal. I even came across this post on Reddit, and didn’t really change my actions. It wasn’t until a few years later when I was 23 during a health scare, when I started to think about what I really want out of life. I realized that I didn’t need to wait until I had a million dollars to start enjoying life. I started making small changes that aligned with my vision. I focused on what truly made me happy and adjusted my savings and investments to support those things. Because of this, I try to travel more, spend time with friends and family and do my hobbies as much as I can. The biggest highlight was that I started swimming, biking and running religiously and I was able to train and do an Ironman with about 1 year of training! If I’m being honest with myself though, I still am sacrificing some of my present for the future.

Like I said earlier, one thing I still struggle with is my career. I don’t necessarily find it fulfilling, and I am not sure if any job would be fulfilling for me. If I loved my job, this channel wouldn’t exist! So I still have things that I need to work on, but I want to try to not just sit stagnant. My plan is to keep trying new jobs, even if they are at the same company. This will allow me to experiment with different jobs, while still earning an income. The next thing is something that is scary but my friend alex has inspired me to really consider through his actions. I want to spend an extended period of time traveling, so instead of waiting for retirement, maybe I can figure out a way to pay my expenses while I travel for a year. I could find a remote job that would allow me to work in different places, or I could save up a travel fund and just quit my job for 6 months to a year. This idea is scary to me because I know that it will delay my retirement plans, but I think the experience would be invaluable and I can afford to do it because of the hard work I’ve put in so far.

In conclusion, the path to financial independence is about much more than money. It’s about creating a life that you love and finding the balance between saving for the future and enjoying the present. By building the life you want and then saving for it, you’re setting yourself up for a fulfilling and meaningful journey.