Sacrifice: I Save 66% of My Income to Retire Early

Every month, I get paid $5000, and I put $2000 towards my investments and $1300 towards my mortgage principal. This means my net savings rate is 66%. Why do I do this? Lets dig into how I manage to save this much money, and find out if I am actually depriving myself of a good life.

Discovering Financial Independence

My First Internship

When I was 20, during my first internship, I had a realization that a 9-5 for the next 40 years would make me miserable. That’s when I began learning about financial independence and early retirement. My first exposure to this word was through Mr. Money Mustache. I used to read his blog posts to and from work on my 1 hour train commute ride. Every single ride I was excited to learn of something new that would help me reach financial independence. Without Mr. Money Mustache, I don’t know where I’d be. He gave me the hope that I needed in a difficult time to move forward. I learned that if I can save enough money, I can live off my investments which would allow me to live a life with less worries and where I don’t have to work a job that I’m not passionate about.

Because I started so early, I was able to shape my life in a way that allows me to save most of my money, while still meeting all my needs and wants.

Living Below My Means

The biggest factor that enables me to save this much money is living below my means. Throughout the years, I was always a frugal guy. I never wanted to spend my money because I knew how hard I worked to actually get it. Fast forward to when my partner and I were looking to purchase a house, we were approved to purchase a $750,000 house. If we had done this, our monthly payment would have been $4683, cutting $1400 out of the $3300 i save.

Instead, we purchased a more modest home that cost $470,000, which meets every single one of our needs. Our monthly mortgage payment is $2000, allowing us to make an additional $2000 payment to our principal and This strategy will enable us to pay off our house in 8 years. Living below our means also gives us insurance in case either my partner or I lose our jobs.

I also choose to live below my means with my car. I drive a 13-year-old Audi which I bought used for $17,000 back in 2016. Yes, it wasn’t the best financial decision since it’s a german car, but it’s cheaper than a new car, and it still saves me money compared to having monthly car payments. Average car payments nowadays are $500 to $1000 dollars per month, so you can see how that would affect someone’s saving rate.

Maximize What You Love, Minimize What You Don’t

Apart from living below my means, the next reason I am able to save this much is because I try to maximize the things in my life that I value, and minimize the things I personally don’t care about.

The most important thing to me is being healthy. What is the point of trying to save all this money if I wont be around to enjoy it? So most of my hobbies are health related so they keep me fit but they also bring me joy. I run, bike, swim, climb, hike, backcountry ski, and more, all without breaking the bank. For me the most important part of all these activities is enjoying the activity itself, feeling present, making memories with friends and family, experiencing nature and of course getting exercise. These could be expensive hobbies but I invest the bare minimum to get the gear I need by finding deals or buying used. Also my job gives us $1000 annually for health expenses, which I use for gear and gym memberships.

Related to healthy living, I also unintentionally save money through my vegan diet. My partner and I spend $200-300 per month on food, making different types of lentil curries, bean and tofu dishes with veggies, rice or pasta. For breakfast, I am a man of consistency and I have had oatmeal with peanut butter and chia seeds almost every day for the past 3 years since I became vegan.

I Still Splurge

Outside of these basics and the things I truly care about, I rarely splurge. I know how hard I work for my money and how my life will change in a few years because of the effort I am putting in now. That being said, I still I set aside about $200 per month towards travel or fun money. and optimize travel by using travel point credit cards, which usually get me one flight for free per year.

The Benefits of Saving This Much Moolah

So now that you understand how I am able to save 66% of my income, let’s talk about the benefits!

- The first and most important benefit is being able to retire early! Starting from zero, with a 65% savings rate and 7% returns, you can retire in 10 to 11 years. For me, that’s far better than retiring in 40 years!

- The second benefit is that you have a financial backup. If I ever lose my job, I can stay above water because I live below my means. The peace of mind from this alone is worth it. I have no financial worries and unexpected expenses might bother me, but they don’t alter my life.

- The third benefit is that it can help you prioritize the things that matter to you. Being frugal has helped me identify and focus on what truly matters to me. I spend more time doing what the things that i love because I know our time on this planet is limited.

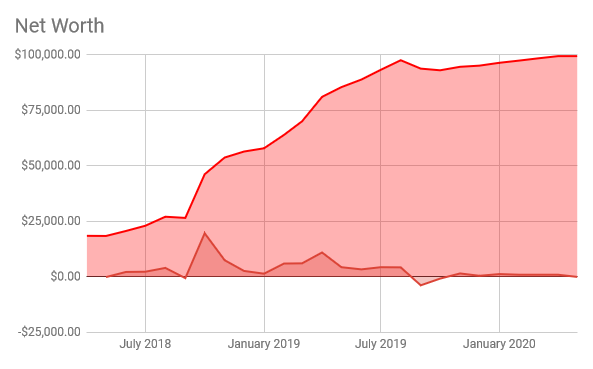

What often gets overlooked in the pursuit of financial independence are the emotional and psychological benefits. When I started this journey, I was anxious and constantly worried about my future. But as I began to save more and see my progress, a sense of calm and confidence took over. Every dollar saved felt like a step closer to freedom.

Living below my means and prioritizing my health has not only improved my financial situation but also my physical and mental well-being. I am in the best shape of my life because of my hobbies and I find joy in the simple things, like spending time with loved ones and being in nature. The peace of mind that comes from knowing I have a plan for my future is truly invaluable. It allows me to be present and fully enjoy the moments that truly matter.

If you’re feeling overwhelmed by financial stress, I encourage you to take that first step towards financial independence. Start small, track your spending and your progress, and celebrate every milestone. There will always be ways to optimize your spending through small changes without huge sacrifices. For example, last year I saved $600 per year on car insurance just by switching companies! I also urge you to just forget the final goal and enjoy the the journey itself, as it can be incredibly fulfilling and transformative. When I look back 7 years, I have made so much progress, not just financially, but physically and mentally, all because I decided to save that first dollar.

Ultimately, saving this much money definitely brings with it a certain life style. Some people might think I’m depriving myself, but I believe frugality has allowed me to discover what truly matters and It’s given my life more purpose and happiness.

Pingback: Build The Life You Want, Then Save For It – Cal's Freedom Journey