My Dream of Retiring at 30: Is it Possible?

When I was 20 years old, I made a vow to myself that I would retire at 30. I wanted to regain my time freedom and live a more meaningful life. My plan was simple. Get $1 million dollars. This is easier said than done, right? So can I actually pull it off? Lets find out.

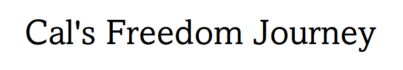

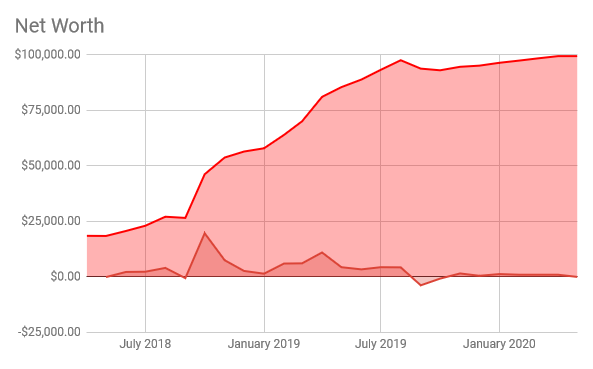

Hey guys, I’m Calin, and I’ve been obsessed with exiting the corporate world ever since my first internship. This journey hasn’t been easy and today, I have roughly $250k invested towards retirement, but the clock is ticking, and that is no where near the $1 million dollars that I need to retire.

Well, Lets talk about my goal, Originally, I wanted to reach $1 million for myself, but luckily, my partner and I think that $1 million should be sufficient for both of us. Our current expenses are about $24,000 without our mortgage, so $1 Million should be plenty considering the 4% rule, which states that you can live off 4% of your investments indefinitely. So, I only need to contribute $500k. Since I have 250k invested, I only need to double what I already have. Easy!

Jokes aside, with only 3 years left, can I actually double my investments?

Figuring out how much I can Invest Per Month

Let’s crunch some numbers and scenarios to find out. I’ll show you guys the process I use to predict when I can retire.

First off, I need to understand how much I can put towards retirement every month. Let’s start with income. Worst-case scenario, without any bonuses, I make around $4500 net. If I push hard, I might get a minimum of a 5% bonus, raising this to around $5000 net. Let’s assume that my income doesn’t grow for the next 3 years also to make it more conservative.

Now, let’s look at expenses. My basic living expenses are about $1830 per month and the breakdown is as follows:

- Mortgage: $998

- Condo Fee: $228

- Insurance: $33 House, $100 Car

- Utilities: $150 (Worst Case)

- Food + Gas: $150 + $120

- Cell + Internet: $50

My partner and I are also making an additional payment to our mortgage of $2000 each month so that we can pay off our house in 8 years. This adds another $1000 to my expenses, bringing it to $2830.

Add in another $170 dollars for fun and uncertainties and this brings my total expenses to $3000.

Now, we subtract our expenses from our income to determine how much we can invest every month. $4500/5000 – $3000 = $1500/$2000

Forecasting Retirement Scenarios

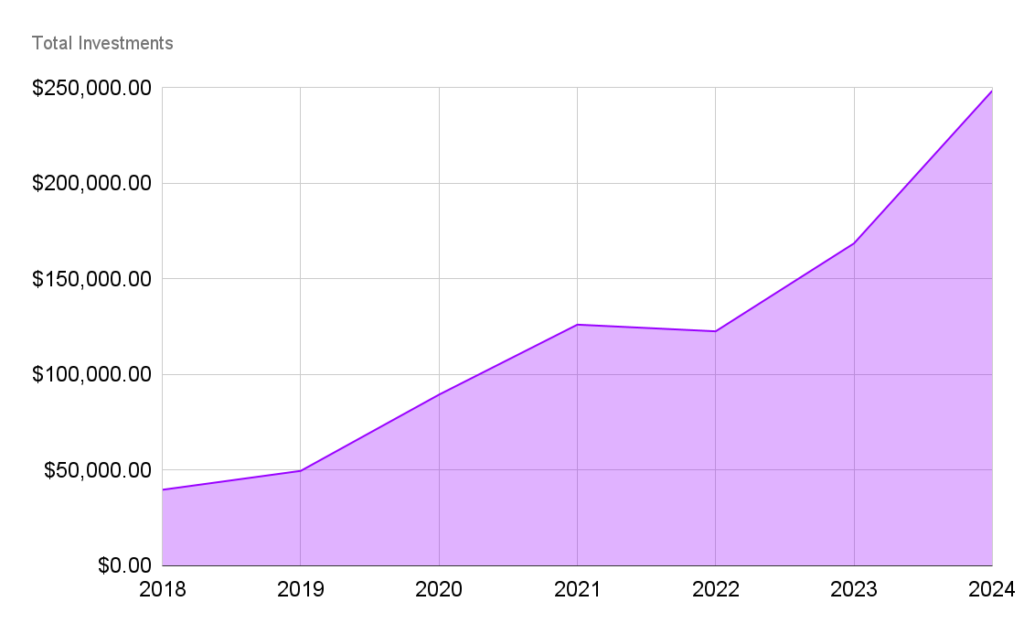

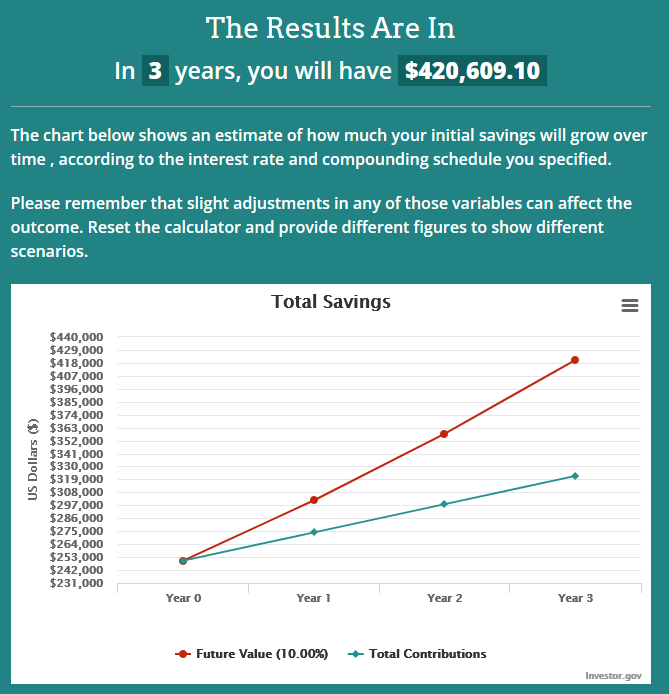

I can invest $1500 to $2000 per month. Is this enough to reach my goal? Lets use a compound interest calculator to see if I can make it happen. I’m using the one at investor.gov. My parameters are $250,000 starting investment, with $1500 and $2000 invested per month, and I want to see what the results are if the returns are 7% and 10%.

You can see above one of the scenario’s that I calculated, and by 30 years old, I’d have $420k. Here are the rest of the scenario’s, which shows what I’d have at 30, and the age that I could retire:

You can see that the fastest that I can retire is when I invest $2000 per month, with 10% average returns at 31. The slowest would be when I invest $1500 per month with 7% average returns, at 33.

So, Can I retire?

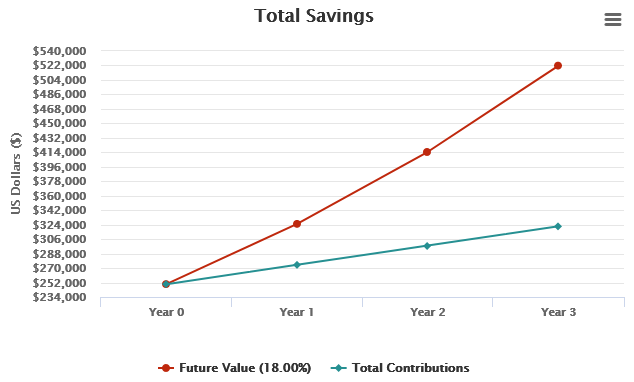

So, based on these realistic scenarios, can I retire by 30? Well, the numbers say… no. but that doesn’t mean it wont happen. The returns I need to reach 500k by 30 are between 17 and 18 percent for 3 years, which is not out this world.

If you read or saw my investment portfolio video, you would have seen that between 2019 and 2021, I averaged about 23-24% returns over those 3 years. So my take away is that IT’S POSSIBLE, and because it’s possible I am going to work hard to get there! Remember that these estimations were intentionally made using conservative numbers in terms of income so that we would have a worst case scenario. In reality, my income will increase over the next 3 years which will allow me to increase my monthly investment, thus allowing me to retire earlier. (For an idea, in 2023 my Income was 75k base + 10k bonus, my income in 2024 is 85k base + 5k bonus + ?? bonus. Hopefully I’ll be able to hit 100k base by 2025!)

Ultimately though, not relying on crazy market returns, retiring at 31 or 32 sounds more realistic. But you know what, that is not a huge deal. If you told that to my 20 year old self when I was first imaging this dream, I would have been ecstatic to hear that I am doing so well at 27. I have put myself in an amazing position by starting that early.

I think a key lesson for me from this whole process is to set lofty goals for myself. It forces me to really think and be creative in order to hit them. Even if you don’t succeed in achieving your goal, you will still be MILES closer than you would have been if you hadn’t set that goal for yourself. If I had gone with conventional advice and simply saved 10% of my income for retirement over the past 7 years, I would not even be thinking about retiring at 40 years old, let alone 30!

Another benefit of starting so early is that it has given me options. Even if I don’t retire at 30, I will have the option to slow down either by working less days per week, or finding a more relaxing job, and coast the rest of the way to retirement.

Hopefully my process of evaluating my retirement goal has helped you. The basics are finding out how much you can invest per month and then using a compound interest calculator to see when you can retire. This requires you to understand your income and expenses, so if you haven’t started to track your spending, you should start now! I’m offering a free budget template if you join my newsletter here.

Another tip for this process is to really play around with a bunch of scenarios to see how small changes can make big impacts! Reducing expenses for example can really accelerate your journey. You can read my blog post about the power of frugality here. I also have a youtube video.