At 27, I’ve managed to grow my portfolio to over $250k in just 6 years through a mix of hard work, discipline, and luck. I’m going to share my journey, from my first really stupid investments to the final controversial one that has doubled in 2 years, and then i’ll finish showing you where I am today. Make sure you read till the end to see how much I’ve profited over the past 6 years!

First Silly Investments

Hey everyone, I’m Calin. At the ripe age of 20, I became jaded with the 9-5 grind and started working towards financial independence. At the beginning, I made some pretty bad decisions! My first investment was $500 into a random mutual fund, and my next two investments were in weed stocks. Dont ask… okay so I sold the weed stocks the next month—they lost me some money, but I learned from the mistake. The mutual fund hasn’t performed that well either; it’s now worth $800.

But it was the spark that ignited the flame for the past 6 years and the lesson here is if you haven’t started investing yet, just get started. YOU WILL MAKE MISTAKES BUT YOU WILL LEARN.

Living In My ETF Era

Shortly after that, one of the best things happened to me—I learned about ETF investing. ETF investing is amazing because it allows you to diversify your holdings by buying just one stock. I personally invested in the S&P 500. But guess what, I made another mistake that cost me money. I invested in the US version of an S&P 500 ETF, VOO, and lost money due to the exchange rate from CAD to USD.

At the time, I put $5,200 in my TFSA, the Canadian equivalent of a US Roth IRA, and $1,000 in my non-registered account. Now, those are worth $11,000 and $2,100 respectively because I never sold because I’m cheap and I don’t wanna pay the exchange rate what can I say.

Luckily, I discovered VFV, the CAD equivalent of VOO so No more wasting money on the exchange rate!

In my RRSP, the Canadian equivalent of a US traditional IRA/401k, I invested $9,000, which is now worth $20,000.

In my TFSA I invested $56,000 over the years, which has grown to $97,000.

Lastly, in a non-registered account, I invested $20,000, and it is now worth $40,000.

Let’s take a break from those big returns. Sometimes, we need some reassurance with guaranteed returns. This past year, with the high interest rates in Canada of around 5%, I put some of my money into an ETF called CBIL, which returns monthly dividends equivalent to about 5% yearly.

I have about $6,400 invested in CBIL in my TFSA, which yields approximately $30 monthly.

Before I talk about my last investment, I should mention that I also have cash accumulated from dividends and uninvested funds which amounts to about $3,000.

The Controversial Investment!

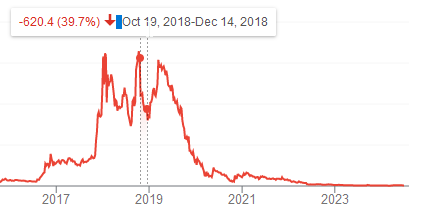

Now lets talk about that final controversial investment that I have been teasing! In 2021, I started investing in Bitcoin, and just a wee bit in Ethereum. I’m still slightly negative on Ethereum; I invested $2,200 near the peak, which is now worth $2,100. Bitcoin is where I’ve seen significant returns.

Even though I started to buy at the peak in 2021, I continued buying as it crashed. In total, I’ve invested $35,000 in Bitcoin, and as of today, it is worth $65,000—doubling in almost 2 and a half years! Since Bitcoin has grown to be such a large percentage of my portfolio, I’ve actually slowed down my bitcoin investments and am focusing more on ETFs again but I truly believe that Bitcoin will change my life in the future, so I will continue to invest in it slowly because the volatility still makes me a bit nervous, but I’m trying to have that diamond hand mentality y’know.

Fun Graphs!

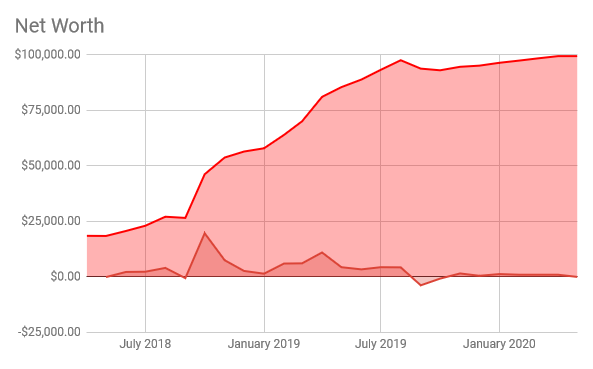

Okay, How about some fun graphs that show the growth now?

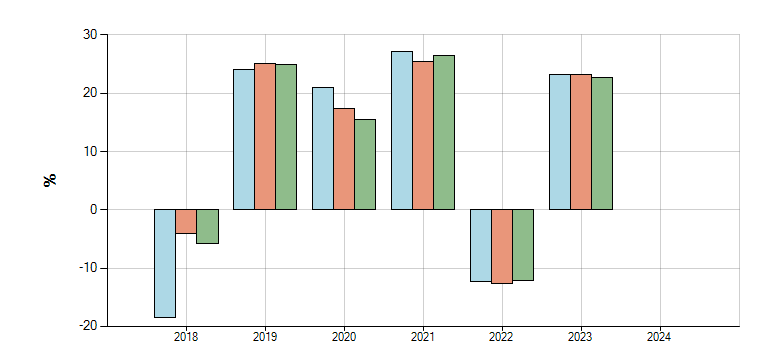

Here is what my yearly returns look like for each year since I started investing for my three investment accounts. You can see that in the good years, I am averaging about +26%, and the bad years I am average about -10%.

This shows why investing works! There are more good years than bad, and the good years outperform the bad years!

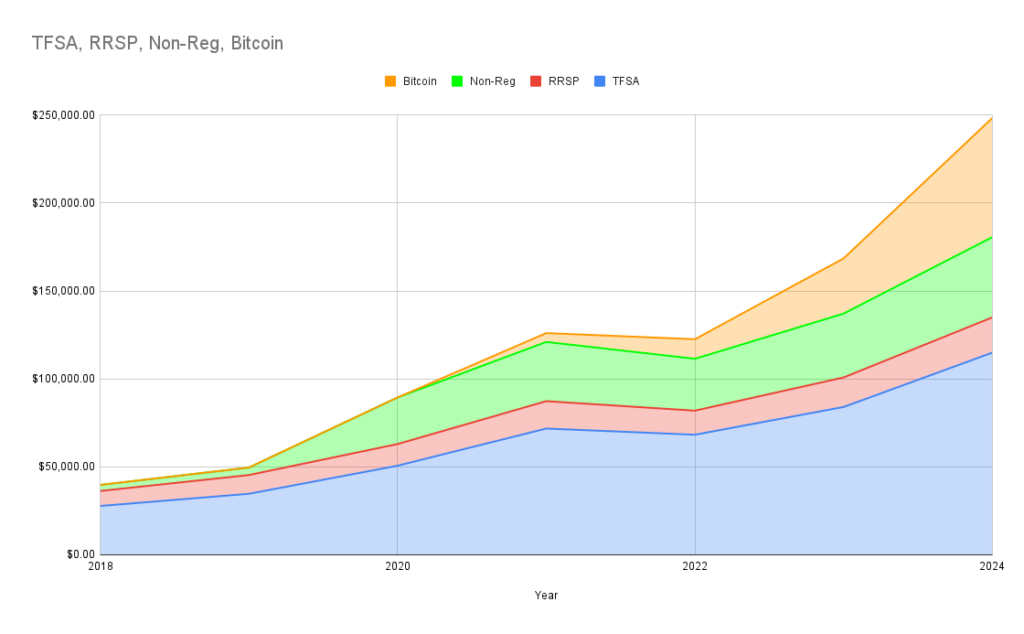

Here is what the value of my investments looks like over the past 6 years. You can really notice it start to pop off in 2023 and 2024 and It’s so satisfying to see compounding do it’s wonderful little job.

You can see my investments actually went down in 2022, which is probably due to Bitcoin crashing to the bottom. But since I kept investing when it was cheap, it gave me so much more growth in 2024.

You can also see how my 4 accounts are distributed, so I have $115K in my TFSA, $20k in my RRSP, $46k in my Non-registered and $68k in Crypto.

Now the final profit results you have all been waiting for. Over 6 years, I have invested $136,000. (Btw, some of this is reinvested dividends which should increase my final growth number but I didn’t account for that!)

As of today, the value of my investments is $248,000, which is $112,000 or 82% total growth.

I hope that from this post, you can see how through consistency and by starting to invest TODAY, you have the power to change the direction of your life. I hope you also see that it is okay to make mistakes. I made several mistakes in the beginning but I learned and grew from them.

Pingback: My Dream of Retiring at 30: Is it Possible? – Cal's Freedom Journey