Have you ever felt frustrated by how little control you have over your time? Imagine having the freedom to do what you want do without financial stress. That’s what having F-U money means. Whether your goal is to escape the work grind or to have more authority over your own life, “The Simple Path to Wealth” by JL Collins will teach you how to get started.

When I first started working when I was 20, I quickly noticed that I was not a fan of having a traditional job. I didn’t have the freedom to do what I want with my time anymore, and the fact that I would have to do it for another 40 years had me straight up depressed… So I did what anyone else would do. I googled how I would be able to stop working as soon as possible. That is when I discovered Financial Independence, Retire Early (FIRE), and “The Simple Path to Wealth” By JL Collins encapsulates all of the fundamentals of financial independence that you need to understand to get started. If I had to recommend one book to anyone eager to achieve financial independence and retire early, it would be this book.

FU Money

Let’s dive right into the concept of F-U money, a core idea that JL Collins talks about. F-U money is about having options and security. It means not living paycheck to paycheck and having enough money saved up to take risks in life—like negotiating for a raise, taking extra vacation time, or quitting a job you hate without needing to have another one lined up.

Collins emphasizes that financial independence isn’t just about the end goal of retirement; it’s about the benefits you gain along the way. This definitely helped me not hyper focus on the end goal, which makes the journey a lot more sustainable.

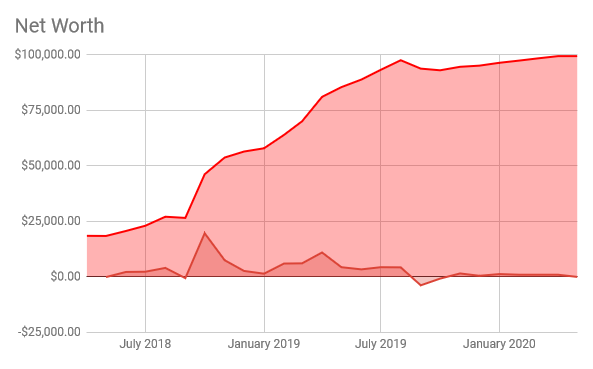

You can achieve F-U money long before you have enough to retire early. In my case, I’m halfway to my retirement goal at around $300,000 net worth, but I already feel the security of F-U money. If I lost my job tomorrow, I could live off my savings for more than 10 years. Having this financial cushion significantly reduces daily stress and it makes unexpected expenses more manageable.

Collins’ emphasis on not focusing on the end goal of retirement helped me break the financial independence journey into distinct steps which gave me more motivation as there was always a goal that is close.

Here’s what I think those stages would be and some tips on how to get to the next stage.

The Stages of Financial Independence:

- Financial Ignorance: This is where we all start out when we begin to learn about money. Essentially,it is not understanding the basics of saving, investing, budgeting, and debt.

- To get to the next stage: Learn the basics and begin tracking spending to understand where your money is going. This book is an amazing resource to move you to the next stage.

- Financial Literacy: This stage is where you have learned the basics and started to set goals to become debt-free and save for retirement.

- To get to the next stage. Begin executing on investing and budgeting. Start early and start strong to front load your journey. Don’t rely on investment growth to reach 100k.

- $100K Liquid Net Worth: this is where you Begin to notice the effects of compounding.

- By getting here, it means you know what youre doing. Keep doing that. One thing id say is If you get pay raises, try to stave off lifestyle creep and invest the extra money to accelerate your growth. This will save you years in your journey.

- F-U Money: in this stage, Life’s challenges are smoothed out because of a financial backup and you can begin to take more risk.

- You can continue what you are doing, you can begin taking risks to speed up your journey or you can start slowing down and letting compound interest do more of the work. Things like coast fire and barista fire start to become possible around this stage.

- Financial Independence and Retire Early (FIRE): this is where it becomes possible to Live off your investments. If you are here, you made it. You can do what you want with your time, continue growing wealth to increase quality of life or just settle down and do what you want to do with your time.

The Basics

In the book, Collins outlines all the basics needed to achieve financial independence, which makes it the perfect book for beginners learning about FIRE.

He explains:

- The 4% rule which states that once your investments are 25x your expenses, you can retire.

- How to invest in index funds.

- The importance of continuing to invest during market downturns.

- The power of Increasing your savings rate.

- How you will accelerate your journey by Living frugally and below your means.

- The benefits of Using tax-advantaged accounts.

- And how to choose your safe withdrawal rate which is the amount you withdraw from investments each year (benchmark is 4%, as per the rule)

When I was first learning the basics, I had to get the information from several sources over several months! The fact that this book puts all this information in about 200 pages is crazy!

The Importance of Avoiding Debt

The last topic I wanted to cover is the importance of avoiding debt, which Collins emphasizes several times. He describes debt as a modern form of slavery, because it limits your options and freedom.

By staying out of debt, or aggressively paying it down, you keep more control over your financial destiny.

This resonates quite deeply with me because I recently became a home owner, and im not going to lie, I feel a pressure to maintain an income because I need to continue paying this debt down.

Collin’s practical advice on how to manage and avoid debt is:

- If you have debt, prioritize paying off high-interest debt first, while making minimum payments on the others. Another method which some people find more motivating is paying off the smallest debts first to gain momentum!

- Try to find extra money to allocate towards debt pay-off by budgeting, and increasing your income through side hustles or part-time work. Take advantage of windfalls like tax refunds or bonuses to quickly pay debt off with money that you had not accounted for.

- Once you’re out of debt, avoid getting into debt by living below your means and avoiding lifestyle creep. An emergency fund of 3-6 months of salary is crucial to weather unexpected expenses.

So whether you’re just starting your financial journey or are well on your way, this book is an incredible resource for learning the fundamentals of financial independence. If you follow the principles that are in the book, you will surely make progress towards your financial goals and eventually become financially independent. If you want to check out “The Simple Path to Wealth” by JL Collins, click here!