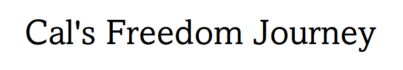

Over the years, I have made some financial mistakes which have cost me over $100,000. In this blog post, I’m going to share three major financial mistakes I made and the valuable lessons I learned from them. Hopefully, by sharing my experiences, you can avoid these pitfalls and accelerate your journey towards financial freedom. Let’s dive in!

Mistake 1: Buying a Used German Car

I was a starry-eyed 19 year old that wanted to get his first new car. Of course I wanted something really cool and sexy… I ended up getting a 2011 Audi A4 for $17,000. At first I was ecstatic, I loved how it looked and it even had a manual transmission which I really wanted. My excitement quickly faded when the issues started popping up.

- Frequent oil leaks and burning oil

- Multiple wheel bearing and serpentine belt issues

- Rust started to appear in the wheel wells

I didn’t realize how expensive maintenance and repairs would be. Over the eight years of ownership, I’ve spent an additional $35,000 on insurance, maintenance, fixes, winter tires, and more. That’s a total of $52,000!

This car became a huge financial drain and a source of stress, especially when unexpected repairs were needed. If I could go back, I would choose a more reliable car, perhaps a Toyota, or even consider not owning a car at all due to the high costs associated with it. Until then though, I am going to run this car to the ground and then maybe spend a few months to a year carless to see if I feel the need to own a car anymore. It’s one thing to be difficult financially, it’s another for it to also be a source of stress!

Lesson Learned: Cars can be a significant financial and mental burden. It’s essential to consider not just the purchase price but also the ongoing maintenance and repair costs. Opt for reliable and economical options to minimize financial and mental strain.

Mistake 2: Pursuing a Costly Master’s Degree

As a mechanical engineering student, I thought pursuing a Master’s degree would significantly boost my earning potential and help me break into a more technical market. However, the reality was different. I am now almost 2 years out of my Master’s and I am still making less than some of my friends who started working right out of their undergraduate. On top of that, while I was studying, I missed out on two years of full-time income. I’m also still working on my thesis while juggling a full-time job and paying tuition. When you consider the lost income for the two years of my Master’s and the tuition cost, this decision has set me back approximately $50,000.

In the end, I did end up breaking into a more technical field which I have enjoyed quite a bit, but I’m realizing that if I just focused on that after my undergraduate, I most likely would have been able to break into this field much earlier, and without needing a Master’s!

Lesson Learned: Higher education can be a worthwhile investment, but it’s crucial to weigh the costs and potential benefits. Consider whether the degree will significantly enhance your earning potential and if it aligns with your career goals. Sometimes gaining work experience and advancing in your field can be more beneficial than additional education. If you are trying to break into a field and you haven’t even tried to apply to some jobs in that field, TRY THAT FIRST!! (I was too dumb to do that…)

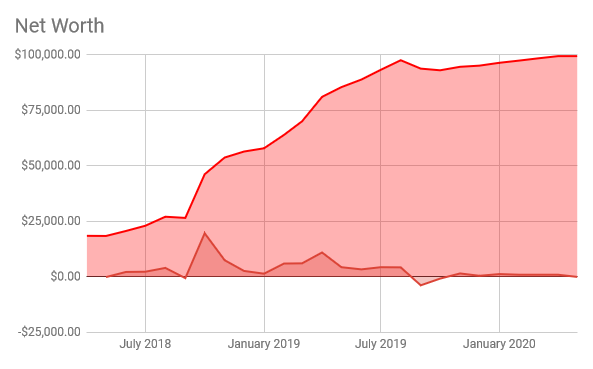

Mistake 3: Selling Bitcoin Too Soon

The third mistake still stings: It was my first rendezvous with Bitcoin, Back in 2017. I saw Bitcoin growing and started buying, eventually getting about 0.1 Bitcoin. It felt surreal to see something that was $10,00 at the beginning of the year, go over $10,000 by the end. I just had to be a part of it. I also seriously thought it was going to go to like $500,000, but that was just me being naive. When the market crashed from its 2017 high, I sold my holdings once I broke even because the rollercoaster ride was too much for me at the time.

Looking back, I now realize how revolutionary Bitcoin is and regret not holding onto it. If I had kept my Bitcoin, it would be worth around 10 times what I sold it for. This mistake cost me about $10,000. On top of that, if I had invested into Bitcoin what I had invested into ETFs, I would have already been retired…

Lesson Learned: Investing in volatile assets like Bitcoin requires a long-term perspective and a strong understanding of the market. While the volatility can be stressful, it’s essential to focus on the potential long-term gains and not make hasty decisions based on short-term market fluctuations. Educate yourself thoroughly before investing and be prepared for the ups and downs. Also, do the research to understand what you are investing your money in, instead of blindly following the hype.

Conclusion

We all make financial mistakes, but the key is to learn from them and make better decisions in the future. Even though these financial mistakes cost me more than $100,000, the lessons that I learned from them will yield me more than that in the future, I am sure. By sharing my experiences with buying a costly car, pursuing an expensive degree, and selling Bitcoin too soon, I hope to help you avoid similar pitfalls. Remember, financial freedom is a journey, and every step you take towards making smarter financial decisions brings you closer to your goals.